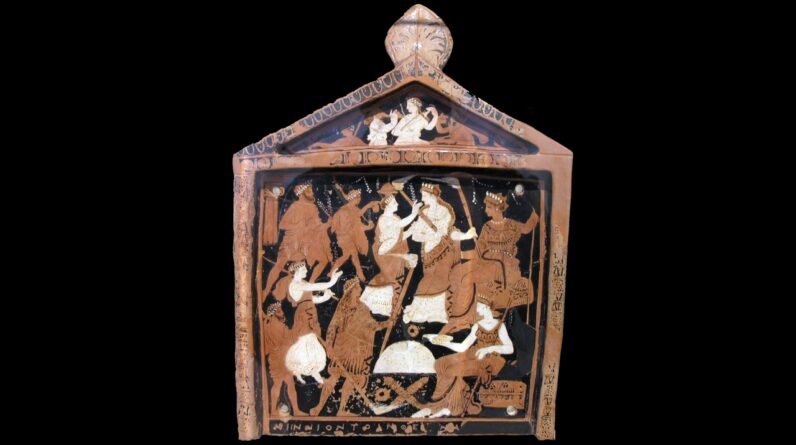

(Image credit: I, Sailko, CC BY-SA 3.0, by means of Wikimedia Commons)

“All I want is an income of 20,000 sesterces from secure investments” announces a character in a poem by Juvenal (initially to 2nd century A.D. ), the Roman poet.

Today, 20,000 sesterces would be comparable to about [Australian] $ 300,000 in interest from financial investments. Anybody would be really delighted with this much passive yearly earnings.

In ancient Greek and Roman times, there was no stock exchange where you might purchase and trade shares in a business.

Get the world’s most interesting discoveries provided directly to your inbox.

If you wished to invest your money, among the more popular alternatives was to get silver or gold.

Individuals did this to safeguard versus currency variations and inflation. They generally kept the metals either in bullion type or in the kind of ware like precious jewelry. Saving these products might be dangerous and vulnerable to theft.

The Roman poet Virgil (70 to 19 B.C.) explains the estate of a rich individual that consisted of “a lofty house, where talents of silver lie deeply hidden” along with “weights of gold in bullion and in ware”

A skill was the biggest system of currency measurement in ancient Greece and Rome, comparable to about 25 kg [55 pounds] of weighed silver.

An information from a mosaic of Virgil Writing the Aeneid, kept in the Bardo Museum in Tunis, Tunisia. (Image credit: Roger Wood/Corbis/VCG by means of Getty Images)Normally the metals were saved in an unique vault or security cabinet.

The Roman author Cicero (106 to 43 B.C.) remembers how a rich woman called Clodia would take gold(maybe bars or ingots or plates)out of a security cabinet when she wanted to

provide cash to somebody. The gold might then be exchanged for coinage.Market booms– and busts

The cost of these metals could, nevertheless, periodically go through unforeseeable changes and crashes in cost, though less typically than currency.

The Greek historian Polybius (c. 200 to 118 B.C.) states that when a brand-new gold vein was found in Aquileia, Italy, just 2 feet deep, it triggered a gold rush. The brand-new product flooded the marketplace too rapidly and “the price of gold throughout Italy at once fell by one-third” after just 2 months. To support the gold cost, mining in the location was rapidly monopolized and managed.

When individuals wished to trade rare-earth elements, they would offer them by weight. If the gold or silver or bronze had actually been infiltrated fashion jewelry or other items, this might be melted down and became bullion.

Individuals need to have enjoyed owning these rare-earth elements.

The Athenian author Xenophon (c. 430 to 350 B.C.) provides an idea about the state of mind of ancient silver financiers:

Silver is not like furnishings, of which a guy never ever purchases more once he has actually got enough for his home. Nobody ever yet had a lot silver regarding desire no more; if a guy discovers himself with a big quantity of it, he takes as much satisfaction in burying the surplus as in utilizing it.

A variety of Roman wills expose individuals leaving their successors silver and gold in the type of bars, plates or ingots.

Roman gold ingot, dating to circa 375 A.D., in the Bank of

England Museum collection.

(Image credit: Joyofmuseums, CC BY-SA 4.0, by means of Wikimedia Commons)Products that might not be ‘messed up by Jupiter’Aside from metals, farming products were likewise incredibly popular, specifically grain, olive oil, and white wine.

To benefit from farming products, individuals purchased farmland and traded the products on the marketplace.

The Roman statesman Cato believed putting cash into the production of vital products was the best financial investment. He stated these things “could not be ruined by Jupiter” — simply put, they were resistant to unforeseeable motions in the economy.

A bust of Emperor Caligula in the Louvre museum (Image credit: confidential, CC BY-SA 3.0, by means of Wikimedia Commons)Whereas rare-earth elements were a shop of wealth, they created no earnings unless they were offered. A varied portfolio of farming products ensured an irreversible earnings.

Individuals likewise invested and sold valuable products, like art work.

When the Romans sacked the city of Corinth in 146 B.C., they took the city’s collection of popular art work, and later on offered the work of arts for big amounts of cash at auction in order to bring revenue for the Roman state.

At this auction, the King of Pergamon, Attalus II (220 to 138 B.C.), purchased among the paintings, by the master artist Aristeides of Thebes (4th century B.C.), for the unbelievable amount of 100 skills (about 2,500 kg [5,500 pounds] of silver).

Eccentric emperorsPolitical instability or unpredictability in some cases raised the rate of these metals.

The Greek historian Appian (secondnd century A.D.) records how throughout the Roman civil war in 32. to 30 B.C.:

the cost of all products had actually increased, and the Romans ascribed the reason for this to the quarreling of the leaders whom they cursed.

Eccentric emperors may likewise enforce brand-new taxes or charges on products, or attempt to control the marketplace.

The Roman historian Suetonius (c. A.D. 69 to 122) informs us the emperor Caligula (A.D. 12 to 41) “levied new and unheard of taxes […] and there was no class of commodities or men on which he did not impose some form of tariff.”

Another emperor, Vespasian (A.D. 17 to 79), presumed regarding “buy up certain commodities merely in order to distribute them at profit” states Suetonius.

Plainly, purchasing products 2,000 years back might assist develop individual wealth– however likewise included some threat, similar to today.

This edited post is republished from The Conversation under a Creative Commons license. Check out the initial short article

Initially from Western Australia, I got my doctorate from the University of Oxford in 2022 as a Clarendon Scholar. My existing work has to do with health in the ancient world, the topic of an approaching book. I am likewise associated with the modifying of unpublished papyri from the Greco-Roman duration.

You need to verify your show and tell name before commenting

Please logout and after that login once again, you will then be triggered to enter your display screen name.

Find out more

As an Amazon Associate I earn from qualifying purchases.