Claim looks for “at least $1.76 billion that was fraudulently transferred” by SBF.

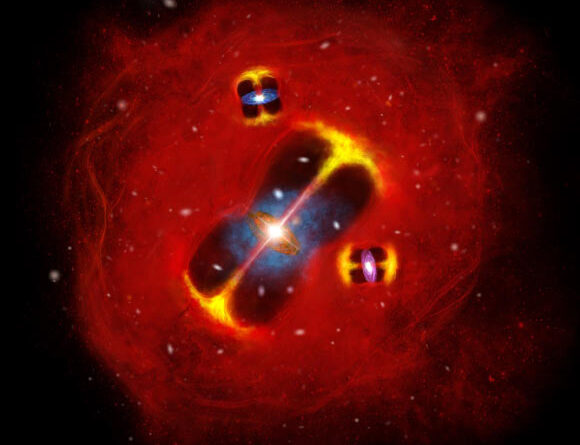

Previous Binance CEO Changpeng Zhao comes to federal court in Seattle for sentencing on Tuesday, April 30, 2024.

Credit: Getty Images|Changpeng Zhao

The personal bankruptcy estate of collapsed cryptocurrency exchange FTX has actually taken legal action against the business’s previous competing Binance in an effort to recuperate $1.76 billion or more. The suit looks for “at least $1.76 billion that was fraudulently transferred to Binance and its executives at the FTX creditors’ expense, as well as compensatory and punitive damages to be determined at trial.”

The problem submitted the other day in United States Bankruptcy Court in Delaware names Binance and co-founder and previous CEO Changpeng Zhao amongst the accuseds. FTX creator Sam Bankman-Fried offered 20 percent of his crypto exchange to Binance in November 2019, however Binance left that financial investment in 2021, the suit stated.

“As Zhao would later remark, he decided to exit his position in FTX because of personal grievances he had against Bankman-Fried,” the suit stated. “In July 2021, the parties negotiated a deal whereby FTX bought back Binance’s and its executives’ entire stakes in both FTX Trading and [parent company] WRS. Pursuant to that deal, FTX’s Alameda Research division directly funded the share repurchase with a combination of FTT (FTX’s exchange token), BNB (Binance’s exchange token), and BUSD (Binance’s dollar-pegged stablecoin). In the aggregate, those tokens had a fair market value of at least $1.76 billion.”

Since FTX and Alameda were balance-sheet insolvent by early 2021, the $1.76 billion transfer “was a constructive fraudulent transfer based on a straightforward application” of personal bankruptcy law, and a deliberate deceitful transfer “because the transfer was made in furtherance of Bankman-Fried’s scheme,” the suit stated.

Alameda might not money the deal since of its insolvency, the claim stated. “Indeed, as Bankman-Fried’s second-in-command, Caroline Ellison, would later testify, she contemporaneously told Bankman-Fried ‘we don’t really have the money for this, we’ll have to borrow from FTX to do it,'” the suit stated.

The grievance declares that after the 2021 divestment, Zhao “set out to destroy” FTX, and implicates Binance and Zhao of scams, adverse fraud, deliberate misstatement, and unjustified enrichment.

Binance is far from the only entity being taken legal action against by FTX. The company submitted 23 suits in the personal bankruptcy court on Friday “as part of a broader effort to claw back money for creditors of the bankrupt company,” Bloomberg reported. Accuseds in other fits consist of Anthony Scaramucci and his hedge fund SkyBridge Capital, Crypto.com, and the Mark Zuckerberg-founded FWD.US.

Claim points out SBF’s incorrect declarations

Ellison, who was sentenced to 2 years in jail, affirmed that Alameda moneyed the repurchase with about $1 billion of FTX Trading capital gotten from depositors, the claim stated. It continued:

Ellison even more affirmed that Bankman-Fried dismissed her issues about funds, informing her that, regardless of the requirement to utilize client deposits, the repurchase was “really important, we have to get it done.” As talked about listed below, one of the factors Bankman-Fried saw the deal as “really important” was exactly since of his desire to hide his business’ insolvency and send out an incorrect signal of strength to the marketplace. In connection with the share repurchase, Bankman-Fried was asked straight by a press reporter whether Alameda moneyed the whole repurchase utilizing its own possessions, revealing surprise that Alameda might have done so provided the purchase cost and what was openly recognized concerning Alameda’s funds. In action, Bankman-Fried incorrectly specified: “The purchase was entirely from Alameda. Yeah, it had a good last year :P” (i.e., an emoji for a tongue protruding).

The deal added to FTX’s failure, according to the claim. It “left the platform in an even greater imbalance, which Bankman-Fried attempted to cover up in a pervasive fraud that infected virtually all aspects of FTX’s business,” FTX’s problem stated. Bankman-Fried is serving a 25-year jail sentence.

Since FTX trading was insolvent in July 2021 when the Binance share repurchase was finished, “the FTX Trading shares acquired through the share repurchase were actually worthless based on a proper accounting of FTX Trading’s assets and liabilities,” the claim stated.

Zhao apparently “set out to damage”

FTX declares that when Zhao divested himself of the equity stake in FTX, “Zhao then set out to destroy his now-unaffiliated competitor” due to the fact that FTX was “a clear threat to Binance’s market dominance.” Zhao resigned from Binance in 2015 after consenting to plead guilty to cash laundering offenses and was sentenced to 4 months in jail. He was launched in September.

FTX’s suit declares that “Zhao’s succeed-at-all-costs business ethos was not limited to facilitating money laundering. Beginning on November 6, 2022, Zhao sent a series of false, misleading, and fraudulent tweets that were maliciously calculated to destroy his rival FTX, with reckless disregard to the harm that FTX’s customers and creditors would suffer. As set forth herein in more detail, Zhao’s false tweets triggered a predictable avalanche of withdrawals at FTX—the proverbial run on the bank that Zhao knew would cause FTX to collapse.”

Zhao’s tweet thread stated Binance liquidated its staying FTT “due to recent revelations.” The claim declares that “contrary to Zhao’s denial, Binance’s highly publicized apparent liquidation of its FTT was indeed a ‘move against a competitor’ and was not, as Zhao indicated, ‘due to recent revelations.'”

“As Ellison testified, ‘if [Zhao] really wanted to sell his FTT, he wouldn’t preannounce to the market that he was going to sell it. He would just sell it […] his real aim in that tweet, as I saw it, was not to sell his FTT, but to hurt FTX and Alameda,'” the suit stated.

The suit even more declares that while FTX was “in freefall, Zhao sent additional false tweets calculated, in part, to prevent FTX from seeking and obtaining alternative financing to cauterize the run on the institution by customers deceived by the tweets. Collectively and individually, these false public statements destroyed value that would have otherwise been recoverable by FTX’s stakeholders.”

Binance calls claim “meritless”

On November 8, 2022, Bankman-Fried and Zhao accepted a handle which “Binance would acquire FTX Trading and inject capital sufficient to address FTX’s liquidity issues,” the suit stated. The next day, Binance released tweets stating it was backing out of the offer “as a result of corporate due diligence.”

When Zhao accepted the offer on November 8, he had “already been made aware of the ‘mishandled’ customer funds during his conversation with Bankman-Fried,” the claim stated. “This is contrary to Binance’s representation in the November 9 Tweets that he learned that fact after entering into the Letter of Intent. In addition, Zhao was also aware that the Debtors were insolvent when he entered into the Letter of Intent.”

In the 24 hours in between the November 8 arrangement and the November 9 tweets, “no new material information was provided to Zhao and Binance in the diligence process that would have revealed new issues” triggering Binance to leave the offer, according to the suit.

Binance stated it will combat FTX’s claim. “The claims are meritless, and we will vigorously defend ourselves,” a Binance representative stated in a declaration offered to Ars.

The offenders likewise consisted of “Does 1-1,000,” individuals who supposedly got deceitful transfers in 2021 and “whose true names, identities and capacities are presently unknown to the Plaintiffs.” FTX is looking for healing of deceptive transfers from all offenders. FTX likewise asked the court to award compensatory damages and discover that Binance and Zhao dedicated scams, damaging fallacy, deliberate misstatement, and unjustified enrichment.

Jon is a Senior IT Reporter for Ars Technica. He covers the telecom market, Federal Communications Commission rulemakings, high speed broadband customer affairs, lawsuit, and federal government guideline of the tech market.

94 Comments

Learn more

As an Amazon Associate I earn from qualifying purchases.